Calculate gross monthly income from hourly

Input this income figure into the calculator and select. Annual salary 52 weekly rate.

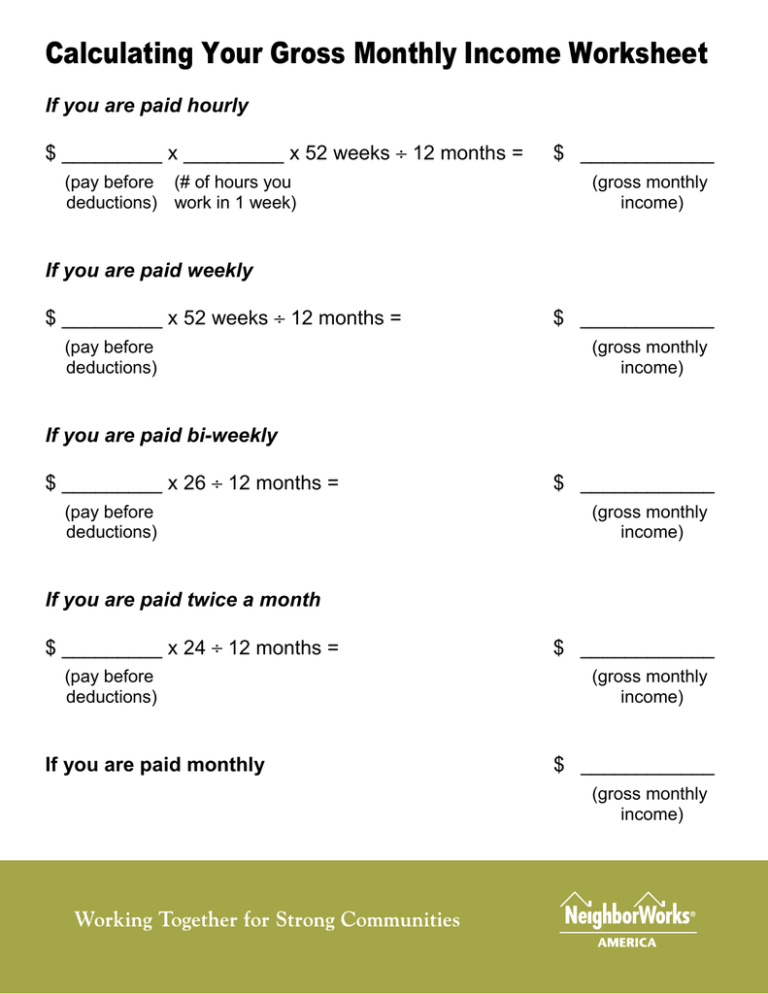

Calculating Your Gross Monthly Income Worksheet

Your pay frequency may differ such as if youre.

. Ariel is a freelance graphic artist. To find out your hourly earnings based on your annual salary follow these simple steps. For those on a bi-weekly schedule you would multiply the number by 26.

To compare annual earnings with industry averages divide your salary by the number of weeks you worked. To calculate an hourly employees gross wages for a pay period multiply their hourly pay rate by their number of hours worked. Employers often delay paydays for hourly employees to allow for time sheet processing.

First calculate your weekly rate. Assume that Sally earns 2500 per hour at her job. Multiply this by 217 to find your gross monthly income if you are paid every two weeks.

A typical calculation for hourly employees is as follows. For example if you make 1850 in take-home pay every two weeks and you know youve been paid 18 times this year you multiply 1850 X 18 to get 33300 That means that after 36 weeks or roughly 83 months your year-to-date net. Divide the employees annual salary by the number of pay periods.

Weekly rate hours worked per week hourly rate. Gross monthly income is the wage an employee earns within a month before taxes or any other deductions. He works in a factory manufacturing consumer products.

Here we walk through the definition and how to find gross monthly income in different cases. Other income Gross Pay. Number of hours worked weekly x.

Therefore the gross income of an employee working 100000 annually would be 4167 if paid semi-monthly. Any wage or salary amount calculated here is the gross income. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year.

Heres one way you can calculate it. The 40 hour work week is 5 8 hour days. Calculate your hourly rates.

You must know your weekly bi-weekly or monthly gross andor net pay amounts depending on how often youre paid. Lets work through how to calculate the yearly figure by using a simple example. This includes unique identifiers and standard information sent by a device for personalized ads and content ad and content measurement and audience insights.

Use our Monthly Gross Income Calculator to calculate your monthly gross income based on how frequently you are paid and your gross income per pay period. To earn a gross pay of 10000month an employee makes 120000 annually and receives 12 paychecks. A semi-monthly pay schedule for hourly employees might be on the 7th and the 22nd of the month for hours worked from the 16th to the end of the month and the 1st to the 15th.

Gross monthly income 953. Assume that there are 52 weeks in a year. If you earn an annual salary most of the work has been done for you.

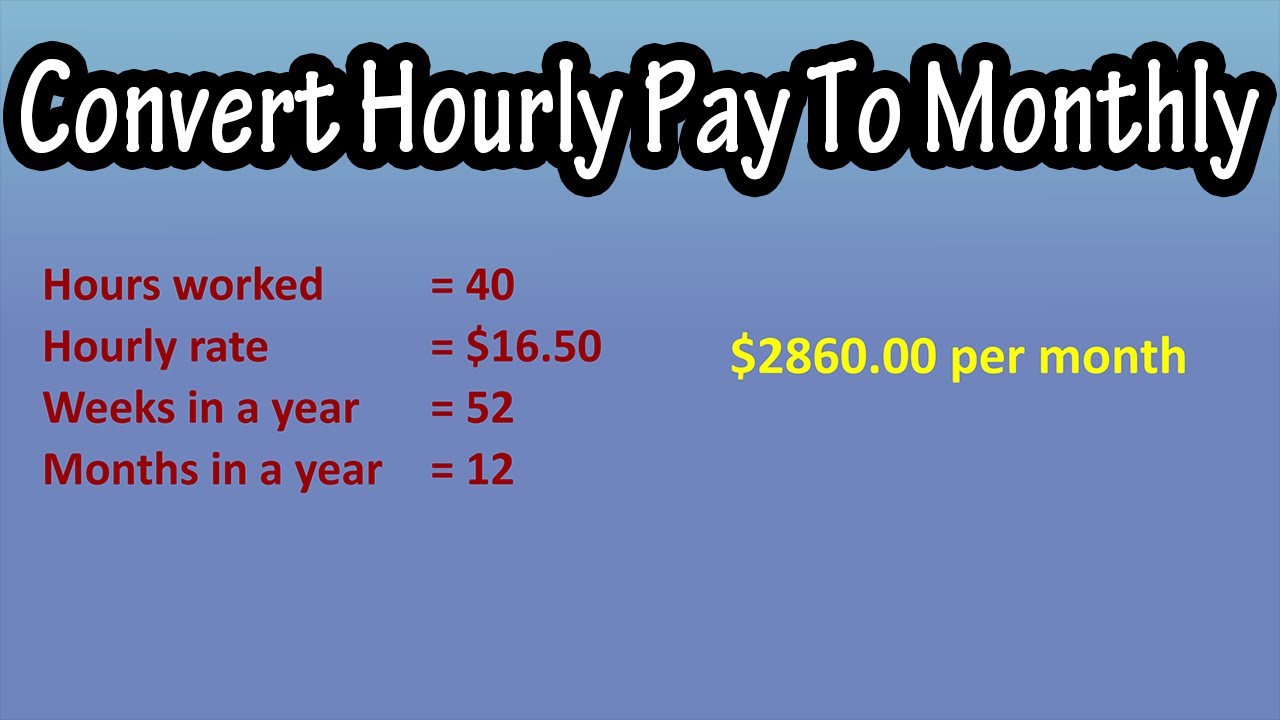

If you work hourly you can refer to your paycheck or simply multiply your hourly wage by the number of hours you worked per week and then multiply that by 52. The individuals gross income every two weeks would be 1923 or. To get your monthly adjusted gross income divide this figure by 12.

What Are the Differences. MORTGAGE RATES. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

If you happen to be a freelance contractor and dont have a basic monthly daily or weekly salary you might receive inconsistent payments every month. Hourly employees often work varying schedules from pay period to pay period. If you are paid hourly multiply your hourly wage by the number of hours you work per week.

Net weekly income Hours of work per week Net hourly wage. Gross pay per check decreases with additional pay periods. Cost of Raw MAterial.

You will see the hourly wage weekly wage monthly wage and annual salary based on the amount given and its pay frequency. Use your gross not net paythat is your amount before taxesand multiply the number by the number of pay periods in a year. This South Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis.

He works for 40 hours a week. How do you calculate annual income. You can easily convert your hourly daily weekly or monthly income to an annual figure by using some simple formulas shown below.

Now we already know that a semi-monthly payment regime has 24 pay periods. This requires you to find an alternative formula to calculate your gross annual income. Gross Pay Hours Worked in a Pay Period Hourly Rate Overtime Hours Hourly Overtime Rate Payroll.

Please note this is based on a 40 hour work week with 52 weeks per year and 12 months per year. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Many people may already know their yearly salary but in the event that you dont check your most recent pay stub.

Heres how a. Net annual salary Weeks of work per year Net weekly income. How to calculate adjusted gross income.

This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis. Joaquin finds that he makes about 953 per month as a waiter. So now we simply need to divide the annual gross income by the number of pay periods.

This is the number of pay periods in the average month given that a 365-day year has 5214 weeks. For example if you earn 2000week your annual income is calculated by taking 2000 x 52 weeks for a total salary of 104000. Gross annual income - Taxes - CPP - EI Net annual salary.

Switch to Georgia salary calculator. Quarter six monthly or yearly. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

We and our partners store andor access information on a device such as cookies and process personal data. Calculate your yearly income. Calculate the gross income from the above details.

Then calculate your hourly rate. With his yearly income amount he can now divide by 12 for the months in the year to determine his gross monthly income. Let us assume that an employee earns a gross of 100000 annually.

His hourly wage is 10.

3 Ways To Calculate Your Hourly Rate Wikihow

Gross Income Formula Step By Step Calculations

Monthly Income Calculator Hotsell 50 Off Www Wtashows Com

How To Calculate Gross Income Per Month

Monthly Income Calculator Online 52 Off Www Wtashows Com

Monthly Salary Calculator Online 56 Off Www Wtashows Com

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Monthly Gross Income Calculator Freeandclear

Gross Income Formula Step By Step Calculations

Salary Calculator

Hourly To Salary What Is My Annual Income

Monthly Income Calculator Online 52 Off Www Wtashows Com

Monthly Income Calculator Online 52 Off Www Wtashows Com

How To Calculate Convert Monthly Salary Earnings Pay From Hourly Pay Rate Formula Monthly Pay Youtube

Monthly Income Calculator Clearance 53 Off Www Wtashows Com

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Gross Income Per Month